owe state taxes but not federal

Related guide for Why Do I Owe State But Not. Its possible especially if you had little or no state tax withheld.

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Ad See if you ACTUALLY Can Settle for Less.

. Why do I owe state taxes but not federal. 100 Money Back Guarantee. Im not going to lie though its probably.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Professional tax relief attorney CPA helping resolve complex tax issues. Its possible especially if you had little or no state tax withheld.

Take Advantage of Fresh Start Options. Free Confidential Consult. Common Reasons for Increased State Taxes You may not have had enough withholding or deductions.

Will I get my federal tax refund if I owe state taxes. The number to call is 800 829-1040. Ad Maximum refund guarantee.

Since you owe on your Federal return after filing it remember that you still have until. Federal income taxes and State income taxes are totally separate. Why do I owe state taxes but not federal.

Can I owe state taxes but not federal taxes. Last year we paid 1200 to Delaware. If you paid too much in taxes during the year through payroll withholdings then you may get a refund.

Another potential issue resulting in owed taxes is the failure to file them on time. This leaves more income to be taxed resulting. If you paid too little in.

Affordable Reliable Services. Generally speaking the annual due date for federal taxes is April 15 May 17 in 2021. 0000 - Why do I owe state taxes but not federal0038 - What reasons can the IRS take your refund0110 - What to do if you owe a lot of taxes0142 - Will.

Affordable Reliable Services. Ad Fill out form to find out your options for FREE. Ad Owe Taxes to the IRS.

Take Advantage of Fresh Start Options. Your Federal Return has to be e-filed first and accepted before you can e-file your state. Free Confidential Consult.

Every tax problem has a solution. Ad See if you ACTUALLY Can Settle for Less. Why do I get a federal refund but owe state taxes.

If you find yourself in a position where you have no federal tax obligation but owe state taxes it is probably because your states deductions and tax rates are not as. Compare 2022s 5 Best Tax Relief Companies See if You Qualify. So it doesnt matter what state you live in you still have to deal with federal taxes.

Only from Jackson Hewitt. Your biggest refund or your tax prep fees back plus 100. Check your state withholding from your W-2 if you have one to see if its.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. State income taxes owed cannot be paid with a federal tax refund. For instance a few years ago the.

In years past we would get a very small refund from NJ but would owe at least a couple hundred in Delaware. Since my income is very low why is that the case. Ad Use our tax forgiveness calculator to estimate potential relief available.

State income taxes owed cannot be paid with a federal. Federal income taxes and State income taxes are totally separate. The income brackets are subject to change over time.

Get a free consultation today gain peace of mind. 2 3 You Owe State Income Taxes The feds can also withhold money from your tax refund to cover any unpaid state income taxes.

How Do Child Support Offsets Affect Tax Refunds And Stimulus Checks Child Support Payments Tax Refund Debt

Us Federal Income Tax Forms 3 Five Things You Probably Didn T Know About Us Federal Income T Income Tax Federal Income Tax Income Tax Return

9 Common Us Tax Forms And Their Purpose Infographic Income Tax Preparation Tax Forms Us Tax

The Collegiates Guide To Taxes Mostly Morgan Tax Prep College Survival Tax

How Does The Deduction For State And Local Taxes Work Tax Policy Center

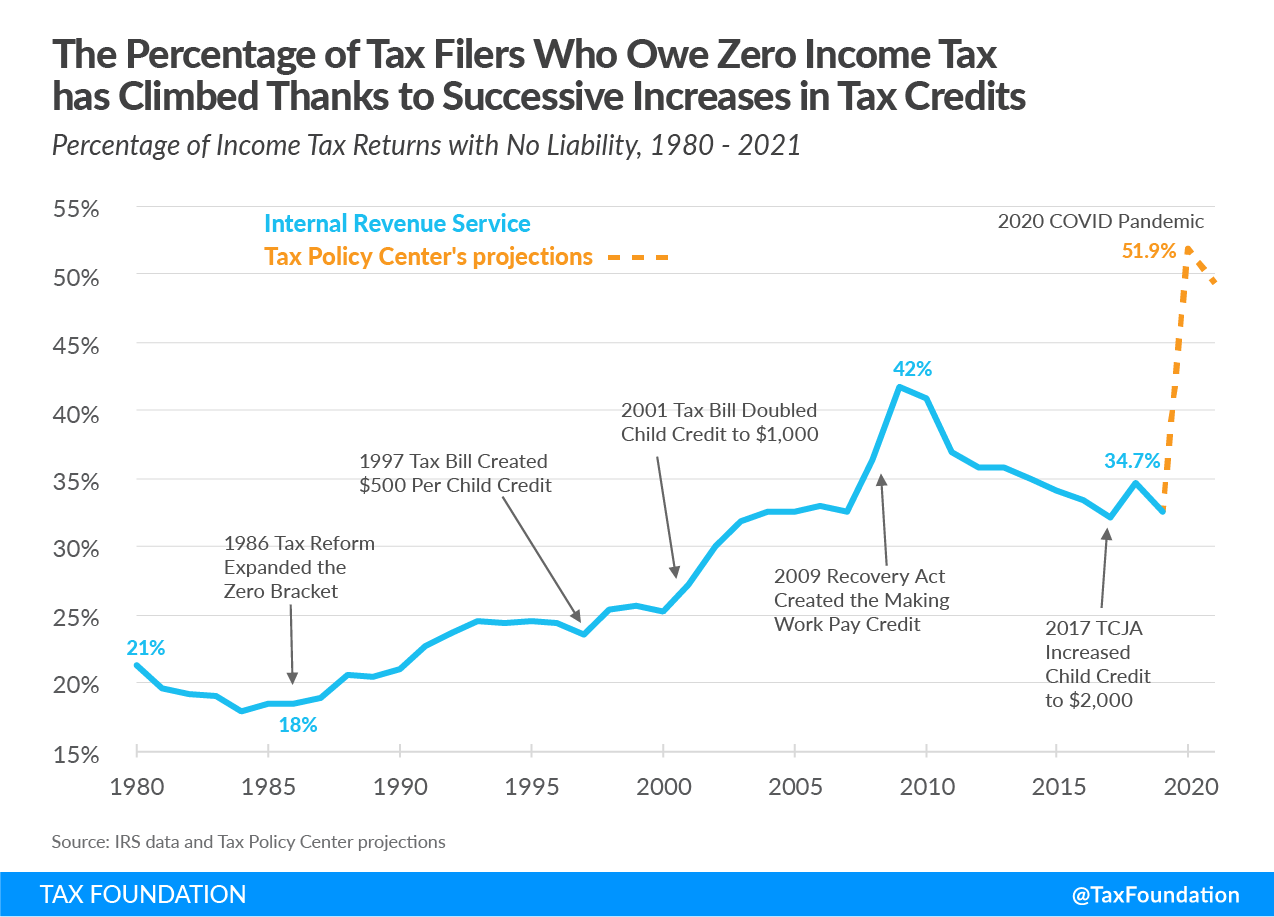

Increasing Share Of U S Households Paying No Income Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

Irs Installment Agreement Georgetown Tn Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

Tax Debt Help Austin Tx 78746 Debt Help Tax Debt Irs Taxes

All Federal Student Loan Forgiveness Programs Are Tax Free But If You Receive Other Types Of Loan Forg Student Loan Forgiveness Loan Forgiveness Student Loans

Quarterly Tax Guide For Freelancers And The Self Employed Tax Guide Business Tax Deductions Small Business Tax Deductions

12 Reasons Why Your Tax Refund Is Late Or Missing

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

How Do I Know If I Am Exempt From Federal Withholding

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Do You Have To File Taxes If You Have No Income Filing Taxes Income Income Tax Return

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)